💡 Quick Overview

- United States: 902 billionaires (2025), with approximately 71% being self-made.

- India: 205 billionaires (2025), with around 54% being self-made.

- Key Sectors: US billionaires often emerge from technology, finance, and entertainment, while Indian billionaires are prominent in pharmaceuticals, automotive, and chemicals.

🌍 Global Billionaire Landscape

As of 2025, the global billionaire count stands at 2,781, with the United States leading at 902 billionaires, followed by China with 450, and India with 205 .

🇺🇸 United States: A Hub for Self-Made Wealth

📊 Key Statistics

- Total Billionaires: 902

- Self-Made Billionaires: Approximately 640 (71%)

- Combined Net Worth: $6.8 trillion

- Top Sectors: Technology, Finance, Entertainment

🏆 Notable Self-Made Billionaires

- Elon Musk: CEO of Tesla and SpaceX, with a net worth of $342 billion .

- Jeff Bezos: Founder of Amazon, with a net worth of $215 billion.

- Mark Zuckerberg: Co-founder of Meta Platforms, with a net worth of $216 billion.

🇮🇳 India: Rising Entrepreneurial Spirit

📊 Key Statistics

- Total Billionaires: 205

- Self-Made Billionaires: Approximately 111 (54%)

- Combined Net Worth: $941 billion

- Top Sectors: Pharmaceuticals, Automotive, Chemicals

🏆 Notable Self-Made Billionaires

- Mukesh Ambani: Chairman of Reliance Industries, with a net worth of $92.5 billion.

- Gautam Adani: Chairman of the Adani Group, with a net worth of $56.3 billion .

📈 Comparative Analysis: US vs. India

| Metric | United States | India |

|---|---|---|

| Total Billionaires | 902 | 205 |

| Self-Made Billionaires | ~640 (71%) | ~111 (54%) |

| Combined Net Worth | $6.8 trillion | $941 billion |

| Top Wealth Sectors | Technology, Finance, Entertainment | Pharmaceuticals, Automotive, Chemicals |

| Average Age | ~65 years | ~60 years |

🧠 Factors Influencing Self-Made Wealth

United States

- Innovation Ecosystem: Strong support for startups and innovation.

- Access to Capital: Robust venture capital and financial markets.

- Cultural Factors: Emphasis on individualism and entrepreneurship.

India

- Economic Growth: Rapidly expanding economy with new opportunities.

- Government Initiatives: Programs like “Startup India” promoting entrepreneurship.

- Demographic Dividend: Young population driving innovation and consumption.

🔮 Future Outlook

- United States: Expected to maintain its lead due to a mature ecosystem supporting innovation and entrepreneurship.

- India: Poised for significant growth in self-made billionaires as economic reforms and digital transformation take hold.

📌 Key Takeaways

- Dominance of the US: The United States currently leads in both the number and proportion of self-made billionaires.

- India’s Potential: India shows promising growth, with increasing numbers of self-made billionaires emerging from diverse sectors.

- Sectoral Differences: While US billionaires often come from technology and finance, India’s are more prevalent in manufacturing and pharmaceuticals.

📚 Frequently Asked Questions (FAQs)

Q1: What defines a self-made billionaire?

A self-made billionaire is an individual who has built their wealth independently, without significant inheritance.(mint)

Q2: Why does the US have more self-made billionaires than India?

Factors include a more developed startup ecosystem, greater access to venture capital, and cultural emphasis on entrepreneurship.

Q3: Which sectors are producing the most self-made billionaires in India?

Pharmaceuticals, automotive, and chemicals are leading sectors for self-made billionaires in India.

Great question!

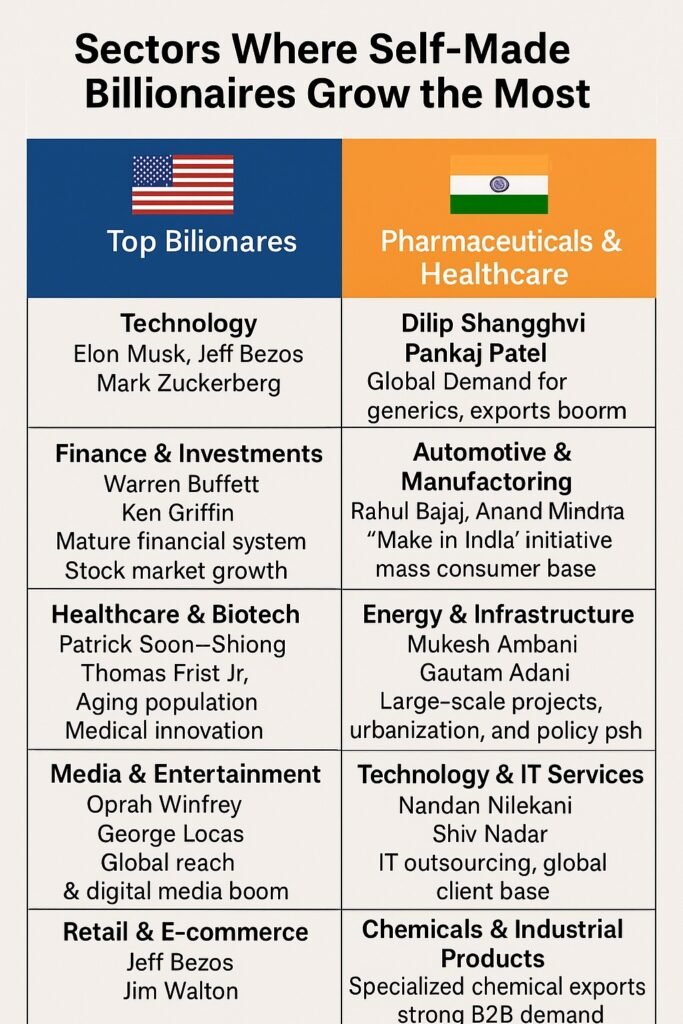

🔍 Sectors Where Self-Made Billionaires Grow the Most (US vs India)

Let’s break this down by country so you can clearly see which sectors produce the highest number of self-made billionaires in the United States and India:

🇺🇸 United States – Billionaire Growth Sectors

| 📈 Sector | 💰 Top Billionaires | 🧠 Why It Leads |

|---|---|---|

| Technology | Elon Musk, Jeff Bezos, Mark Zuckerberg | Innovation, scalability, and VC funding |

| Finance & Investments | Warren Buffett, Ken Griffin | Mature financial system and stock market growth |

| Healthcare & Biotech | Patrick Soon-Shiong, Thomas Frist Jr. | Aging population, medical innovation |

| Media & Entertainment | Oprah Winfrey, George Lucas | Global reach and digital media boom |

| Retail & E-commerce | Jeff Bezos, Jim Walton | Online shopping revolution and brand expansion |

📌 Key Insight: The U.S. tech and finance sectors are the fastest paths to self-made billionaire status due to digital products, platform-based businesses, and stock valuations.

🇮🇳 India – Billionaire Growth Sectors

| 📊 Sector | 💼 Top Billionaires | 🌱 Why It Leads |

|---|---|---|

| Pharmaceuticals & Healthcare | Dilip Shanghvi, Pankaj Patel | Global demand for generics, exports boom |

| Automotive & Manufacturing | Rahul Bajaj, Anand Mahindra | “Make in India” initiative and mass consumer base |

| Energy & Infrastructure | Mukesh Ambani, Gautam Adani | Large-scale projects, urbanization, and policy push |

| Technology & IT Services | Nandan Nilekani, Shiv Nadar | IT outsourcing, global client base |

| Chemicals & Industrial Products | Ashwin Dani, M.P. Ramachandran | Specialized chemical exports, strong B2B demand |

📌 Key Insight: India’s billionaire growth is industry-led rather than digital-led. Manufacturing, pharma, and infrastructure dominate, with tech slowly catching up.

🎯 Comparison: US vs India – Billionaire Sector Growth

| 📌 Sector Type | 🇺🇸 United States | 🇮🇳 India |

|---|---|---|

| Technology & Internet | 💥 Dominant driver of wealth | 🌱 Emerging but not dominant |

| Pharma & Healthcare | 📈 Growing steadily | 💰 Major billionaire sector |

| Finance & Investments | 💰 Long-time stronghold | 🔁 Developing ecosystem |

| Real Estate & Infrastructure | 📉 Not dominant | 📊 Vital sector in billionaire count |

| Entertainment & Media | 🌟 High influence | 🎬 Limited billionaire presence |

🔮 Sectoral Trends to Watch

- In the US: AI, space tech, fintech, and biotech will likely create the next generation of billionaires.

- In India: Clean energy, fintech, digital education, and health tech are expected to grow billionaire numbers in the next 5–10 years.

💼 Final Takeaway

➡ If you’re tracking billionaire growth, the US favors fast-scaling, tech-based innovation, while India’s strength lies in legacy industries, exports, and industrial growth.

✅ Key Growth Sectors:

- US: Technology, Finance, Biotech

- India: Pharmaceuticals, Automotive, Infrastructure

📌 Conclusion

While the United States currently leads in the number of self-made billionaires, India’s rapid economic growth and supportive policies indicate a promising future. Both countries showcase the potential for individuals to build significant wealth through innovation, entrepreneurship, and strategic investments.

📢 Disclaimer

This article is for informational purposes only and does not constitute financial advice. The information provided is based on publicly available data as of 2025 and may be subject to change. Readers are encouraged to conduct their own research before making any financial decisions.